Before recording transactions, one of the first things to set up is the chart of accounts. That’s because it plays an important part in bookkeeping and acts as the foundation of a business’s financial system.

But, you might be wondering, what is a chart of accounts?

When doing bookkeeping, every financial activity must be recorded in a specific account and each account falls under one of five categories. The chart of accounts is an index or list of all those accounts used by a business to record financial transactions. It makes it easy to see what accounts are in each category and gives order to record-keeping.

Account Categories

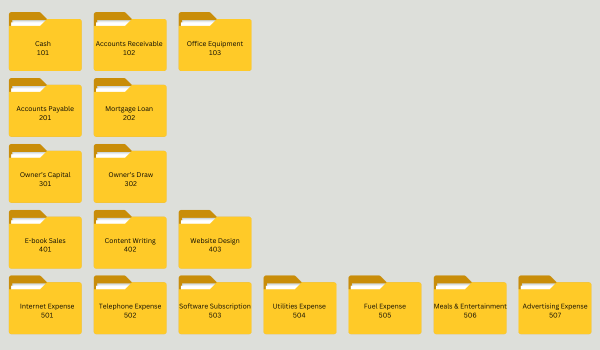

Let’s picture a filing cabinet with five drawers. Each drawer will be labeled as such: Assets, Liabilities, Owner’s Equity, Revenue, Expenses. These are the categories.

Then, each category will be assigned a number. The commonly accepted numbering system assigns 1 to assets, 2 to liabilities, 3 to equity, 4 to revenue and 5 to expenses.

Accounts

In each drawer, there are folders. Each folder will represent an account and will store information about similar transactions.

The Assets drawer will contain information about everything the company owns. This will include cash, accounts receivable, office equipment.

The Liabilities drawer will contain records of what the company owes, like accounts payable and mortgage loan.

In the Owner’s Equity drawer, the folders will be about the owner’s share or what they can claim after deducting liabilities from assets. Things like owner’s capital and owner’s draw.

Ok, let’s look at the last two drawers.

The Revenue drawer will contain all records of the business’s income and their sources. For example, e-book sales, content writing service, website design.

Records about money spent for running the business will go in the Expenses drawer. This will usually have the most number of folders. Examples are internet expense, telephone expense, fuel expense, meals and entertainment, software subscriptions, utilities expense, advertising expense, etc.

Now each of those folders will have a number that starts with the drawer number. Let’s see the illustration below.

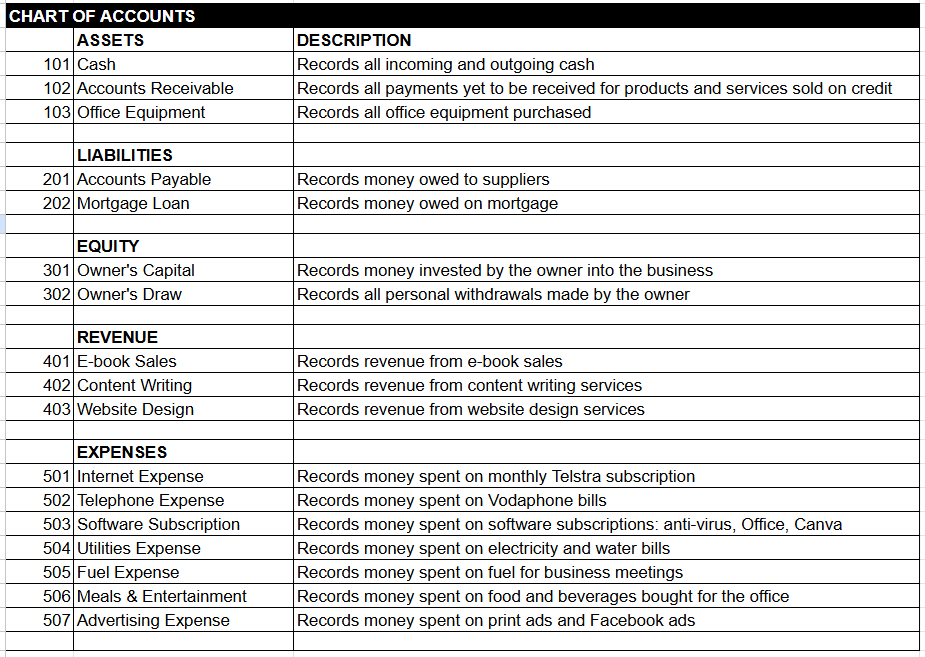

Chart of Accounts

Ok, let’s say we want to record a payment made for an anti-virus subscription. If we have hundreds of folders in the Expense drawer, it’ll be a bit difficult to find the Software Subscription folder, especially if we can’t remember what number it is. Heck, we might even forget what the name of the folder is. This is where the chart of accounts comes in handy.

Let’s create a chart of accounts for our folders.

Notice that the table includes a description for each account. This is highly recommended as it will serve as a guide when sorting transactions as well as when checking accounts. Now, whenever we need to record something, we just need to look at the chart of accounts to know exactly where it should go.

Quick Tip

In the world of accounting, it’s common for the asset accounts to be numbered in order of liquidity or how easily they could be converted to cash. On the other hand, liabilities are usually numbered based on how urgently they need to be paid. This isn’t a hard rule but quite practical when it comes to reporting.

Summary

The chart of accounts is a systematic way of listing all of a business’s accounts to make recording transactions efficient and more organized. When financial records are in order, it’s easier for you to see a clearer picture of where your company stands. It also produces cleaner reports for when you need them.

While there are no fixed rules when creating a chart of accounts and it differs for each business, I hope this post helps you create a COA that’s clean and easy to use.